Summary

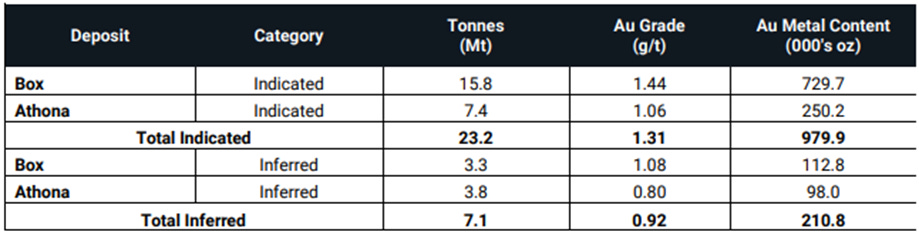

Fortune Bay (TSX-V: FOR) owns 100% of the Goldfields Project in Saskatchewan, Canada. The project is anchored by the Box and Athona deposits, which together contain over 1.1 million ounces of gold at a 0.30 g/t gold cut-off:

979,900 ounces of gold in the Indicated category (23.2 million tonnes at an average grade of 1.31 g/t gold)

210,800 ounces of gold in the Inferred category (7.1 million tonnes at an average grade of 0.92 g/t gold)

Like the previously discussed Ixhuatan project, Goldfields has been held for years by companies led by Wade Dawe. A 2022 PEA valued Goldfields at an after-tax NPV of C$285 million (5% discount rate), with a 35.2% IRR and a 1.7-year payback, based on a gold price of US$1,650/oz. Since then, gold has marched above US$3,000/oz—well beyond the assumptions used in that analysis.

If Fortune Bay updates its PEA to reflect current gold prices, the project’s strong sensitivity to gold would result in a significantly higher NPV. This is due to Goldfields’ low capital costs, thanks to established infrastructure, and low operating costs driven by a favorable 3:1 strip ratio. The project also has an approved Environmental Impact Statement from 2008 for an open-pit mine at the Box deposit and a 5,000 tpd mill, which should help streamline the project’s path toward construction.

Ownership and Project History

The Goldfields Project in northern Saskatchewan has a long history, starting with the discovery of gold in the 1930’s by surface prospecting. The Box deposit was developed by Consolidated Mining and Smelting of Canada, (Cominco), now Teck Resources (TSX: TECK), which operated an underground mine from 1939 to 1942. During that time, the mine produced around 64,000 to 68,000 ounces of gold before shutting down due to labour shortages caused by World War II. Around the same time, the nearby Athona deposit was explored by Athona Mines, but it never reached production due to a lack of power and processing infrastructure.

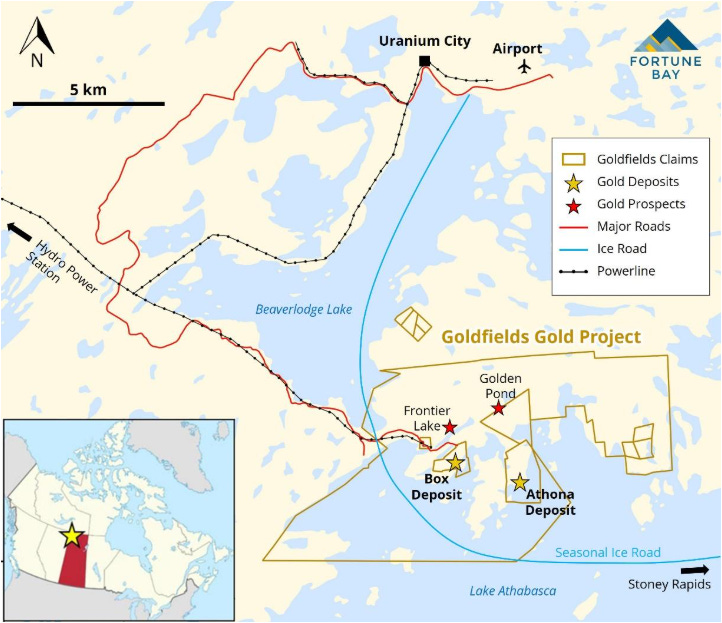

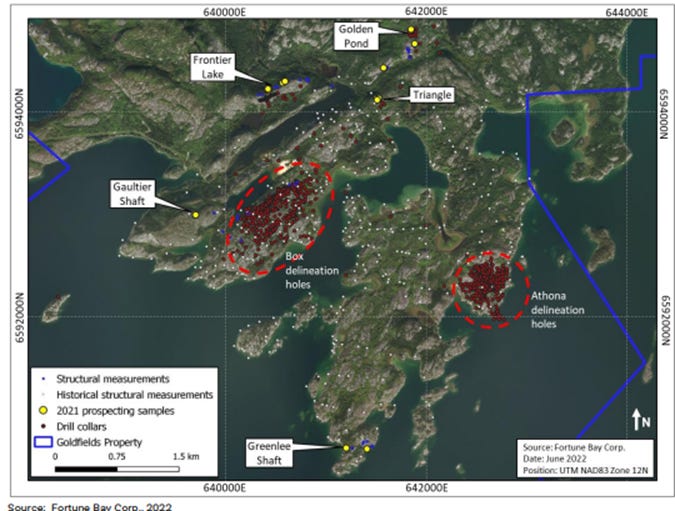

Exhibit 1: Goldfields Project Map

After World War II, exploration in the region shifted to uranium, and little work was done on the gold deposits until the late 1980s. In 1987, Lenora Exploration and Mary Ellen Resources optioned Box and Athona, later merging with AXR Resources to form Greater Lenora Resources (TSX: GEN), which became GLR Resources (TSX: GLR). Over the next two decades, GLR and its affiliated companies (often referred to as the Kasner Group) carried out significant drilling and engineering work. In 2008, they received environmental approval to develop an open-pit mine and 5,000 tonne-per-day mill at Box. This environmental impact survey currently remains valid and could be amended to include the Athona deposit and increase in the processing plant capacity from 5,000 to 7,500 tonnes per day.

GLR Resources relied heavily on debt to fund the development of the Goldfields project. When the 2008 financial crisis froze global credit markets, the company could no longer raise the funds needed to advance the project or repay its existing obligations. With no access to new capital and limited cash, GLR was forced into bankruptcy.

In 2009, GLR sold the project to Linear Gold (TSX: LRR), under the leadership of Wade Dawe, for US$5,000,000 in cash, the assumption of certain liabilities and the issuance of 727,272 common shares of Linear. Linear then merged with Apollo Gold (TSX-V: APGO) in 2010 to form Brigus Gold (TSX: BRD). Three years later, Brigus was acquired by Primero Mining (TSX: P). As the project wasn’t core to Primero’s operations, it was spun out into a new company called Fortune Bay.

Fortune Bay has held the Goldfields Project since then, quietly advancing it with minimal share dilution while waiting for more favorable gold market conditions. Exploration led by Fortune Bay started in 2015, focusing on evaluating known gold showings and the development of new targets. During that year, SGS Canada tested samples from the Box and Athona deposits. Gold recoveries were high—94–98% for Box and 92–98% for Athona—using whole ore leaching. Flotation tests also performed well. Problematic elements like arsenic and copper were low, and reagent consumption was minimal, indicating simple and cost-effective metallurgy.

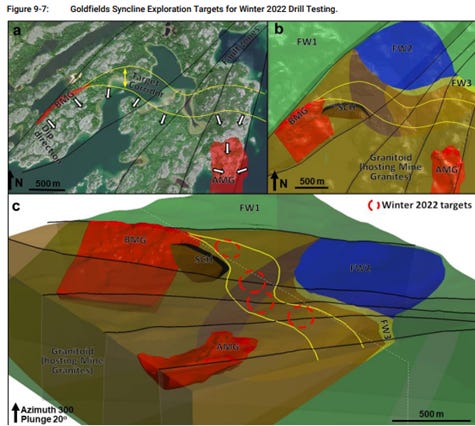

Fieldwork and data reinterpretation in 2021 led to the generation of drill targets within the Goldfields Syncline, particularly between the Box and Athona deposits.

Two drilling phases were completed between January 2021 and March 2022:

Phase 1 (2021): 13 holes totaling 5,174 meters (7 at Box, 6 at Athona), aimed at expanding mineral resources and testing deeper and along-strike extensions.

Phase 2 (Winter 2022): 5 holes totaling 1,772 meters, including 4 exploration holes in the Syncline and one resource expansion hole at Box.

Exhibit 2: Mineral Resource Statement, Box and Athona Deposit

Preliminary Economic Analysis

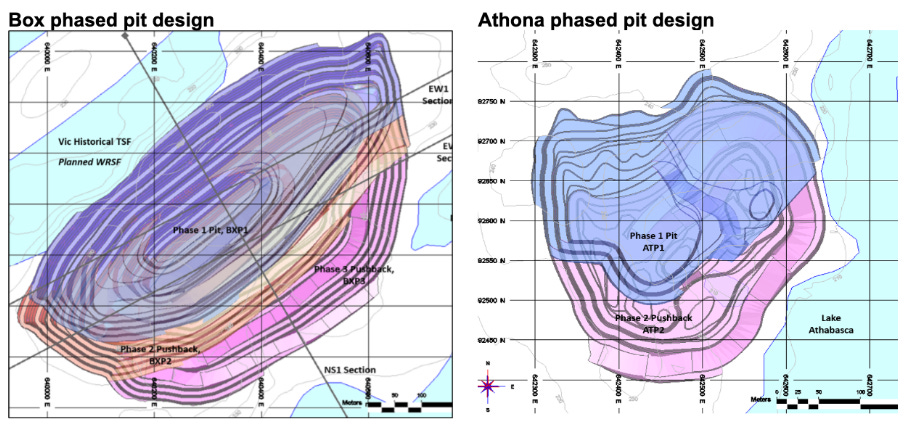

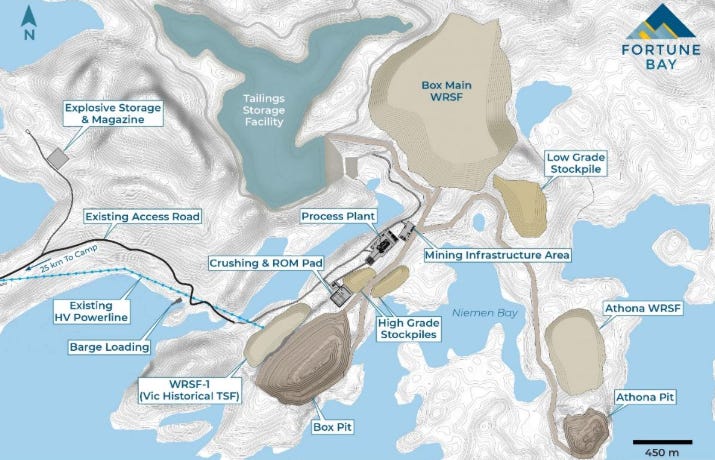

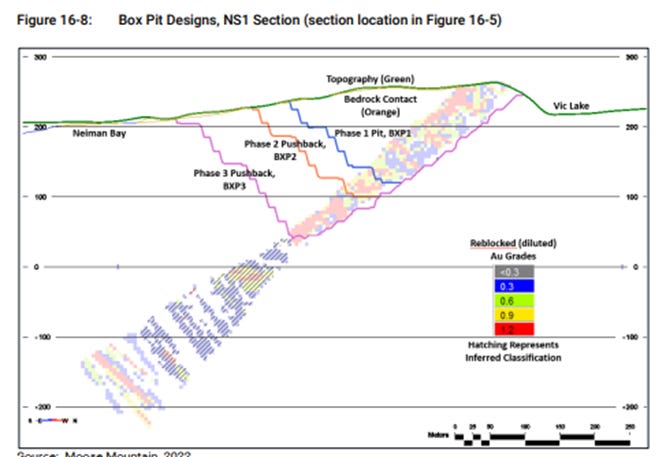

Fortune Bay’s 2022 PEA outlines an 8.3-year open-pit mine at the Box and Athona deposits, using conventional methods and phased pit designs to prioritize higher-grade ore early (see exhibit 3). The project benefits from a low strip ratio of 3:1 and existing road and power infrastructure that require only minor upgrades—contributing to relatively low capital and operating costs.

Exhibit 3: Box and Athona Pit Design

Exhibit 4: Goldfields Site Layout

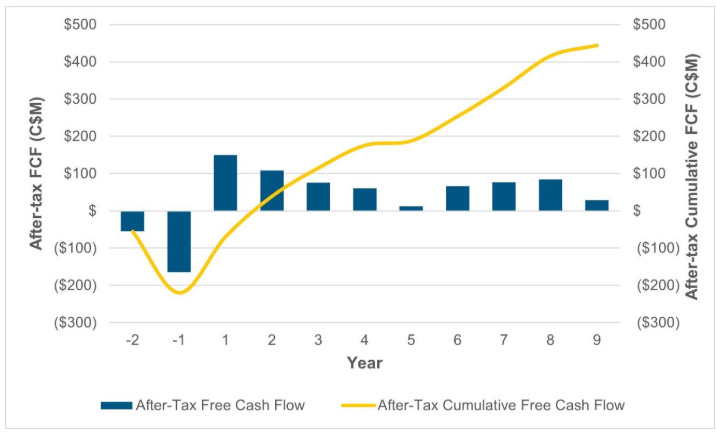

Exhibit 5 shows the projected flow for the project, with cumulative after-tax free cash flow totaling C$435 million. At a gold price of US$1,650/oz, the payback period is just 1.7 years— a fast return that again reflects the project’s strong early cash flow and low upfront capital requirements.

Exhibit 5: After-Tax Free Cash Flow Profile

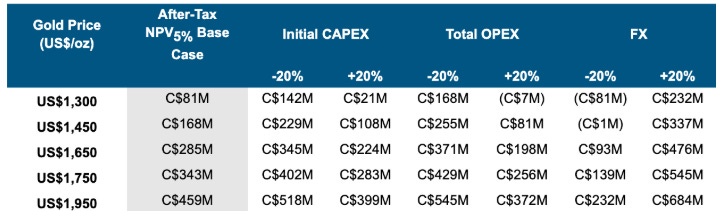

Most importantly, the project is highly sensitive to gold prices—a rise in gold significantly increases the project’s net present value (see exhibit 6).

Exhibit 6: After-Tax NPV5% Sensitivity

A US$200 increase in the gold price—from US$1,750 to US$1,950 (an 11% rise)—results in a 33% increase in the project’s NPV. While it's difficult to calculate the NPV at US$3,000 gold without an updated PEA, it’s possible that the NPV could approach C$1 billion, given the project’s strong sensitivity to gold prices.

While inflationary pressures have driven up the cost of mining inputs— labor, energy, steel, concrete, reagents, and equipment—since 2022, the impact on Goldfields should be muted. The project benefits from existing infrastructure and an efficient mine plan, which should help maintain relatively low capital and operating costs compared to more remote mining projects. Additionally, at higher gold prices, the project’s mine plan could be expanded to incorporate additional mineral resources.

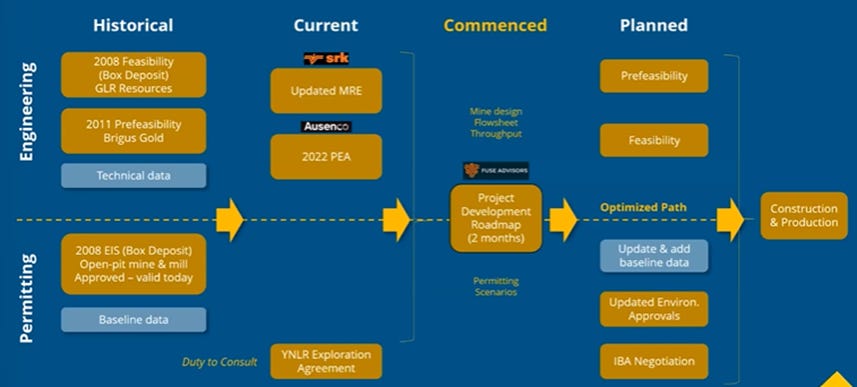

Fortune Bay has engaged Fuse Advisors to develop a comprehensive roadmap for advancing the Goldfields Project toward construction and production. The study will build on the 2022 PEA and the valid 2008 Environmental Impact Statement (EIS), while leveraging a wealth of historical technical data—including past feasibility work and an updated resource model. It will evaluate a range of mine design, processing, and permitting scenarios, such as alternative flow sheets, incorporation of the Athona deposit, and whether to amend the existing EIS or file a new one. The outcome will be a fully scoped plan and budget to guide the project into either a pre-feasibility or full feasibility study.

Exhibit 7: Goldfields Advancement Summary

Geology and Exploration Potential

The Goldfields Project is located within a very old and stable part of the Earth's crust called the Rae Craton, part of the Canadian Shield. This area has a complex geological history, shaped over billions of years by ancient mountain-building events, collisions between tectonic plates, and multiple periods of deformation and metamorphism.

The local geology includes very old basement rocks (around 3 billion years old), overlain by younger volcanic and sedimentary rocks known as the Murmac Bay Group. These rocks were folded, faulted, and metamorphosed over time, and later intruded by granites and other igneous rocks. The Goldfields deposits lie within a structural domain called the Beaverlodge Domain, which hosts a variety of rock types and features several major fault zones.

This complex geological setting—shaped by multiple tectonic events between about 2.4 and 1.8 billion years ago—created the conditions necessary for gold mineralization, including the development of fractures and the movement of mineral-rich fluids. While the geology is complex, the takeaway is that Goldfields sits in a highly prospective, well-understood gold-bearing district with a long history of exploration and mining.

The Box and Athona gold deposits, located about two kilometers apart, are geologically similar and likely formed from the same processes. Both are found within a large folded rock structure called the Goldfields Syncline—Box sits on one side of the fold, while Athona is near the center.

Gold at both sites is hosted in granite-like rock which contains networks of white quartz veins. These granites are thought to have formed through a mix of heat and fluid activity, though experts differ on whether they started as melted rock or altered sedimentary layers.

What matters most is that these granite units are more brittle than the surrounding rocks, making them more likely to crack and fill with gold-bearing quartz veins during geological movement. Most of the gold is found in these veins, which tend to trend north-south and dip steeply west.

Exploration potential at Goldfields extends beyond the currently defined Box and Athona deposits. Both deposits remain open—Box at depth and Athona along strike—offering potential for future resource expansion.

Exhibit 8: Box Pit Design

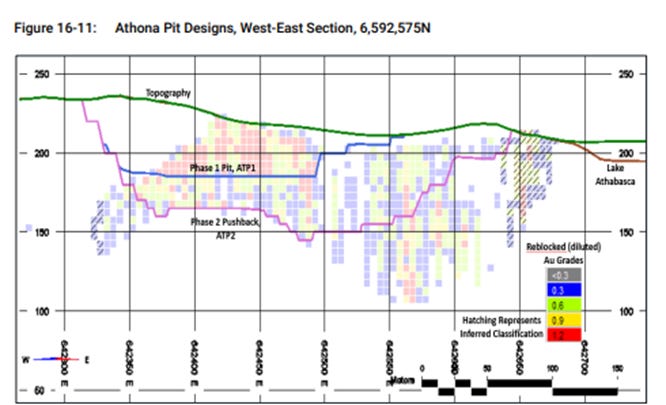

Exhibit 9: Athona Pit Design

The Goldfields Syncline is a large, folded geological structure that hosts both the Box and Athona deposits and is considered one of the most prospective areas for new discoveries on the property. In 2022, Fortune Bay completed four exploration drill holes along a 2 km stretch of the syncline between the two deposits. These holes targeted areas at the base of the Murmac Bay Group, where gold mineralization has historically been concentrated.

This “target corridor” between Box and Athona remains largely untested and could hold additional near-surface gold mineralization that would be straightforward to integrate into the existing mine plan. As such, the Goldfields Syncline presents an opportunity to expand the resource base close to existing infrastructure.

Exhibit 10: Goldfields Syncline Target

In addition, the property hosts several underexplored gold occurrences, including Frontier Lake and Golden Pond. At Frontier, historical exploration includes 26 drill holes, 3,275 meters of drilling, and over 2,000 assay samples. The best historical drill result returned 102.37 g/t gold over 1 meter (hole LBU-11), though average grades were lower (0.28 g/t) and the mineralized footprint was limited. Some zones showed potential continuity along vein structures, but follow-up is needed to evaluate scale.

Exhibit 11: Goldfields Exploration

Golden Pond, located about 2 km northeast of Box, also returned encouraging results. Notable historical drill intersections include 20.9 g/t over 4 m (including 104.6 g/t over 0.5 m) and 5.1 g/t over 15 m (including 25.1 g/t over 1 m). However, drilling to date has been sparse, and mineralized vein trends remain open to the northeast.

While both targets exhibit promising grades, additional drilling is required to assess their continuity and economic potential. If proven viable, they could serve as satellite feed to a central mill, improving overall project economics.

Community Consultation

Unlike Ixhuatan, community agreements are not a central part of the Goldfields story—though they remain an important aspect of the project’s development. Fortune Bay’s 2022 PEA notes that the company has built strong relationships with indigenous rights holders and local municipalities. According to the company, no environmental or social risks have been identified that can’t be managed through standard practices.

The Athabasca region boasts a rich mining heritage, and the province of Saskatchewan consistently ranks among the top jurisdictions globally for mining investment attractiveness. According to the Fraser Institute's 2023 Annual Survey of Mining Companies, Saskatchewan was ranked third worldwide, reflecting its favorable mineral potential and supportive mining policies.

Final Thoughts

The Goldfields Project, alongside Ixhuatan, is a core asset supporting Fortune Bay’s C$28 million market cap. Under Wade Dawe’s leadership, the project has been held back with discipline, waiting for stronger gold prices to justify advancing the asset. Now, with gold trading above US$3,000/oz, the conditions for proceeding with the project are more favorable than ever. Ideally, the company will soon publish an updated PEA that contemplates higher gold prices in its scenario analysis, giving investors a clear picture of what the Goldfields project is worth.